3 Reasons RIVN is Risky and 1 Stock to Buy Instead

Shareholders of Rivian would probably like to forget the past six months even happened. The stock dropped 20.5% and now trades at $10.91. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Rivian, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we don't have much confidence in Rivian. Here are three reasons why we avoid RIVN and a stock we'd rather own.

Why Is Rivian Not Exciting?

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

1. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Rivian has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants whose fleets are too young to generate substantial aftermarket revenues have negative gross margins. As you can see below, these dynamics culminated in an average negative 60.5% gross margin for Rivian over the last four years.

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Rivian posted positive free cash flow this quarter, the broader story hasn’t been so clean. Rivian’s demanding reinvestments have drained its resources over the last four years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 161%, meaning it lit $160.69 of cash on fire for every $100 in revenue.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

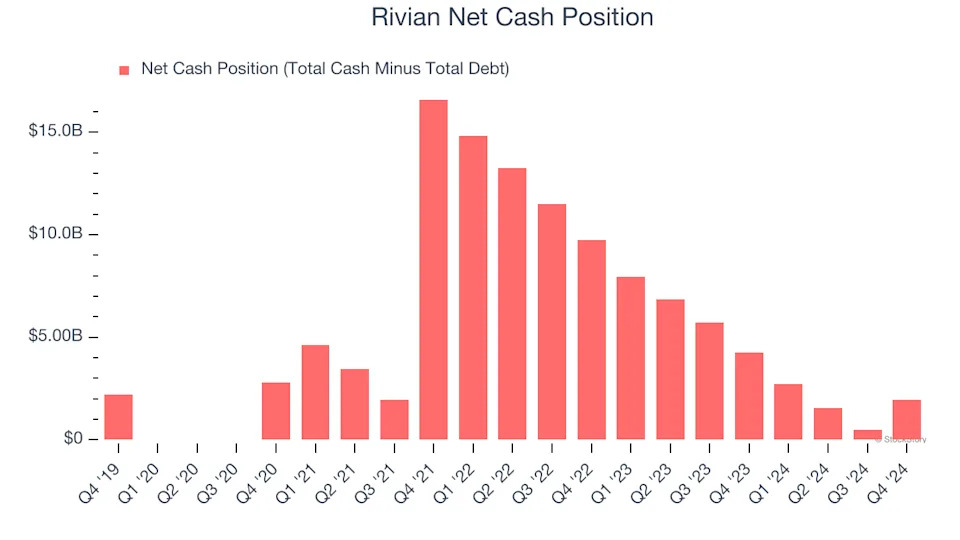

Rivian burned through $2.86 billion of cash over the last year. With $7.7 billion of cash on its balance sheet, the company has around 32 months of runway left (assuming its $5.74 billion of debt isn’t due right away).