3 Reasons to Avoid W and 1 Stock to Buy Instead

Wayfair has gotten torched over the last six months - since September 2024, its stock price has dropped 23.5% to $34.25 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Wayfair, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Despite the more favorable entry price, we're swiping left on Wayfair for now. Here are three reasons why W doesn't excite us and a stock we'd rather own.

Why Do We Think Wayfair Will Underperform?

Founded in 2002 by Niraj Shah, Wayfair (NYSE:W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

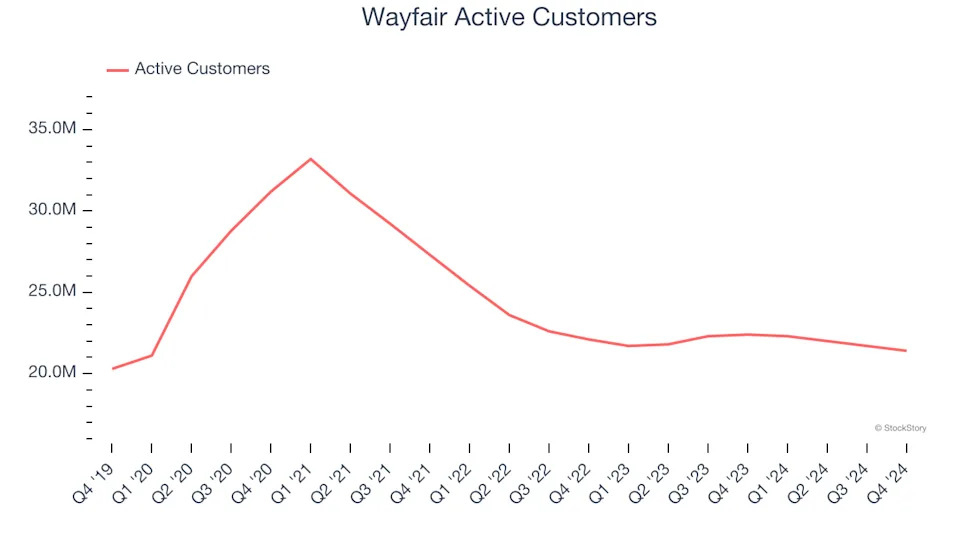

1. Declining Active Customers Reflect Product Weakness

As an online retailer, Wayfair generates revenue growth by expanding its number of users and the average order size in dollars.

Wayfair struggled to engage its audience over the last two years as its active customers have declined by 3.2% annually to 21.4 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Wayfair wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

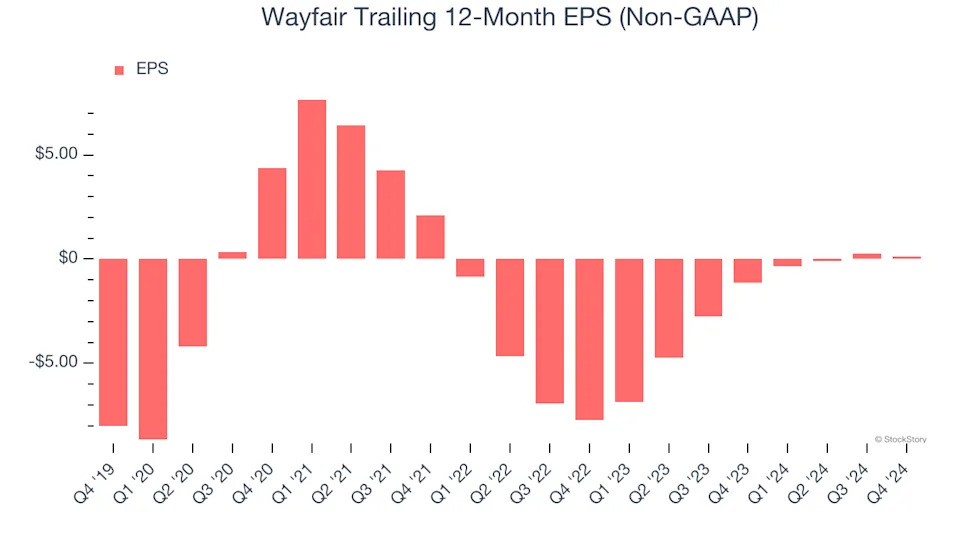

2. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Wayfair, its EPS declined by 60.8% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

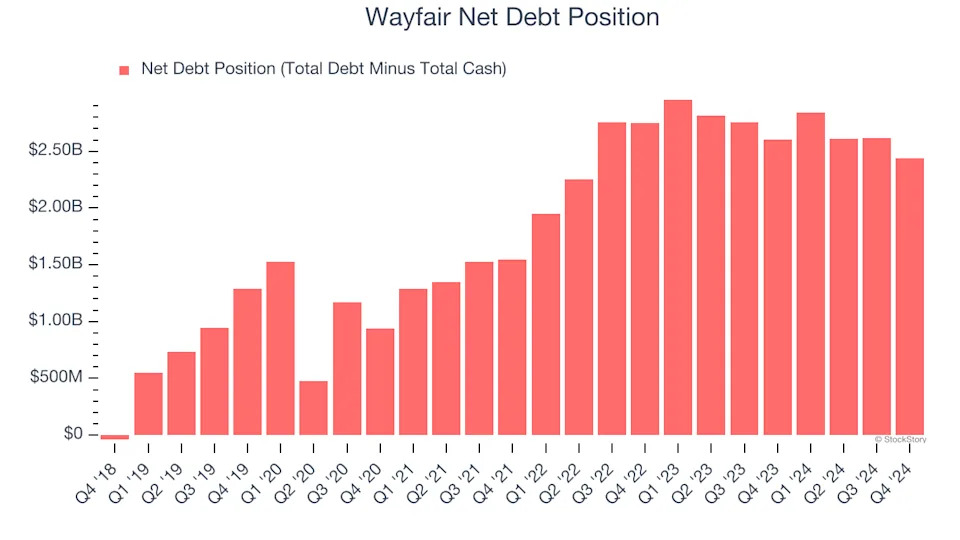

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Wayfair’s $3.81 billion of debt exceeds the $1.37 billion of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $453 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Wayfair could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.