Robinhood May Enter S&P 500 Club: A Win for Retail Investors?

Robinhood Markets Inc.

HOOD is poised for potential inclusion in the S&P 500 Index, with an official announcement expected tomorrow. The index’s quarterly rebalancing occurs later this month.

Per the latest guidelines for the stocks' inclusion in the S&P 500 index, companies must have a market value of at least $20.5 billion and be profitable on a GAAP basis for the past four quarters cumulatively and in the most recent quarter. HOOD fits the bill. It has a market capitalization of almost $63 billion and has been consistently profitable over the trailing four quarters.

Inclusion in the S&P 500 is significant, as it often leads to increased demand from index funds and passive investors who aim to replicate the index's performance. This heightened demand can boost a company's stock price and liquidity. For Robinhood, such inclusion would not only validate its growth trajectory but also enhance its visibility and credibility in the financial markets. However, the company must navigate potential challenges, including market volatility and regulatory scrutiny, especially given its involvement in cryptocurrency trading.

HOOD's recent stock performance has been impressive, with a 94% rally this year. This has been driven by the expansion of its product suite, acquisitions, and favorable developments in the cryptocurrency space.

Image Source: Zacks Investment Research

Last month, Robinhood’s competitor,

Coinbase Global

COIN, joined the S&P 500 Index. In the week following the announcement of its inclusion in the index, Coinbase shares soared 33.7% despite the news of a hack and regulatory scrutiny. America’s largest registered cryptocurrency exchange, Coinbase, is well-placed to capitalize on heightened crypto market volatility and rising asset prices.

Another HOOD peer that could become a part of the index this time is the global electronic broker,

Interactive Brokers

IBKR. With a market cap of approximately $87 billion, Interactive Brokers has been witnessing solid improvement in profitability as retail market participation continues to rise. This year, Interactive Brokers' stock has gained 16.6%.

Robinhood's potential inclusion in the S&P 500 could be seen as a triumph, symbolizing the growing influence of retail trading platforms in mainstream finance. It underscores the shift towards democratized investing, where individual investors have greater access to financial markets.

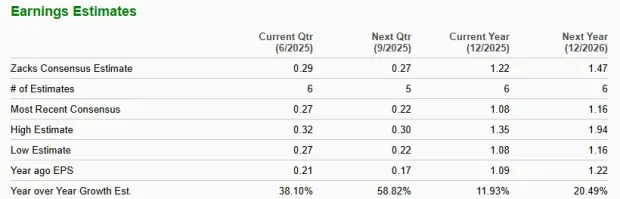

Robinhood’s Valuation and Estimate Analysis

Given the solid price performance, HOOD shares are currently trading at a massive premium to the industry. The company has a forward price-to-earnings (P/E) of 54.33X compared with the industry average of 13.61X.