Action in Hong Kong Equity Markets Stirs Most Excitement in Years

(Bloomberg) -- Hong Kong’s equity capital markets are seeing the most action in years, with multibillion dollar deals lifting the mood and fueling anticipation about more transactions to come.

Most Read from Bloomberg

“I don’t think we have seen this kind of excitement for Hong Kong and China for a long time,” said Cathy Zhang, head of Asia-Pacific equity capital markets at Morgan Stanley.

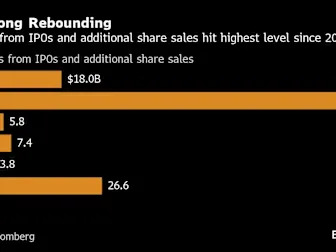

Initial public offerings and additional share sales in the city have fetched $26.5 billion so far in 2025, compared with just $3.8 billion a year ago and the most since 2021, which was a record year, data compiled by Bloomberg show.

Three $5 billion-plus share offerings by Chinese giants have driven the boom. The most recent was battery maker Contemporary Amperex Technology Co. Ltd.’s listing, the biggest worldwide this year. That was preceded by Xiaomi Corp. and BYD Co. selling over $11 billion worth of new stock combined in March.

If fast-fashion giant Shein Group Ltd. goes ahead with an IPO in Hong Kong instead of London, it would be yet another high-profile deal for the city.

Despite global unrest, trade war threats and persistently sluggish demand in China, investors are clamoring for a piece as valuations are still attractive.

“There’s a broader global rebalancing underway, not just in trade flows, but in capital allocation,” said James Wang, head of Asia ex-Japan equity capital markets at Goldman Sachs Group Inc. “Incrementally, we’re seeing capital flow out of the US and into select emerging markets, including India and Hong Kong.”

Hong Kong is poised to be a beneficiary of the strained ties between Washington and Beijing, as Chinese companies shift their IPOs to the city, helping to lift sentiment, according to Bloomberg Intelligence strategist Marvin Chen. That view is shared by former Morgan Stanley Asia Chairman Stephen Roach.

A large chunk of Hong Kong’s pipeline consists of mainland China-traded firms looking to sell shares in the city, encouraged by regulatory support for such deals, and as markets onshore remain slow for fundraising.

CATL is rare in that it is trading at a premium to its shares in Shenzhen, having risen about 18% since its Hong Kong introduction in May. Jiangsu Hengrui Pharmaceuticals Co., which raised $1.3 billion in a Hong Kong listing last month, also briefly rose above its A-shares in Shanghai on its debut. This could further encourage China-traded companies to consider listings in Hong Kong.