Here's Why Investors Should Avoid Allegiant Stock for Now

Allegiant ALGT is facing significant challenges from rising operating expenses and a deteriorating liquidity position, which are adversely affecting the bottom line and making it an unattractive choice for investors’ portfolios.

Let’s delve deeper.

ALGT: Key Risks to Watch

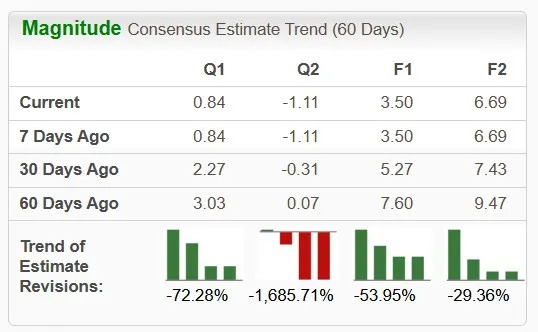

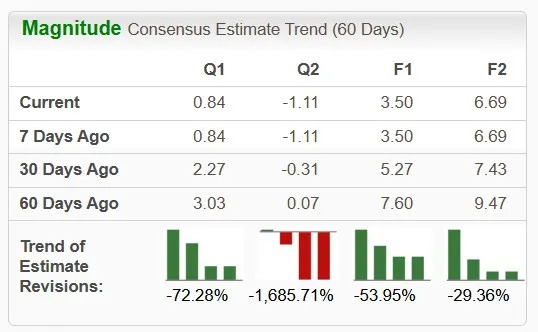

Southward Earnings Estimate Revision: The Zacks Consensus Estimate for current-quarter earnings has moved 72.3% south in the past 60 days. For the next year, the consensus mark for earnings has been revised 54% downward in the same time frame. The unfavorable estimate revisions indicate brokers’ lack of confidence in the stock.

Image Source: Zacks Investment Research

Unimpressive Price Performance: Allegiant shares have declined 40.8% year to date compared with the industry’s 7.3% fall.

Image Source: Zacks Investment Research

Weak Zacks Rank: ALGT currently carries a Zacks Rank #5 (Strong Sell).

Bearish Industry Rank: The industry to which ALGT belongs currently has a Zacks Industry Rank of 149 (out of 246). Such an unfavorable rank places it in the bottom 39% of Zacks Industries.Studies show that 50% of a stock price movement is directly related to the performance of the industry group it belongs to.

A mediocre stock within a strong group is likely to outclass a robust stock in a weak industry. Reckoning the industry’s performance becomes imperative.

Advertisement: High Yield Savings Offers

Headwinds: Allegiant is under increasing pressure on its bottom line due to rising expenses, which are challenging its financial stability. In the first quarter of 2025, the company’s operating expenses, though they have fallen, continue to remain at an elevated level. The total operating expenses account for 90.7% of the total operating revenues. This rise was largely driven by higher labor costs, and elevated maintenance and repair expenses.

Labor costs, comprising salaries and benefits, rose 8.5% year over year. Maintenance and repair expenses increased 15.1% on a year-over-year basis. The company is now grappling with the impact of these escalating costs, which are putting additional strain on its profitability and overall financial health.

Moreover, a downward trend was observed in ALGT’s current ratio from 1.47 in 2022 to 0.78 in 2023. Further, in the first quarter of 2025, the current ratio was pegged at 0.78. This, indeed, is concerning as it questions the company’s ability to meet its short-term obligations.

Stocks to Consider

Investors interested in the Transportation sector may consider Copa Holdings CPA and Ryanair RYAAY.

CPA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .