3 Key Reasons to Buy Fortinet Stock Beyond its 11% Year-to-Date Rise

Fortinet

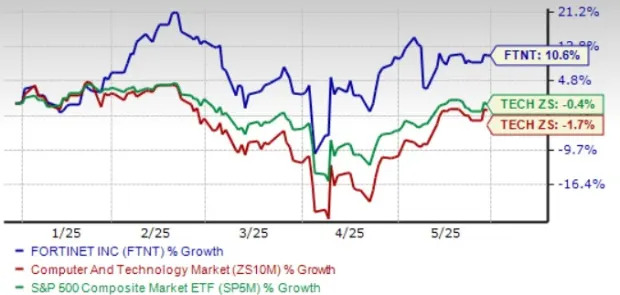

FTNT shares have gained 10.6% in the year-to-date (YTD) period, outperforming the Zacks Computer and Technology sector and the S&P 500 index’s decline of 1.7% and 0.4%, respectively.

FTNT’s outperformance can be attributed to strong execution across key growth areas like SASE, AI-driven security operations and OT security. Record margins, robust free cash flow and rising enterprise adoption have reinforced investor confidence, positioning Fortinet as a resilient, high-growth player in an otherwise cautious tech environment.

Fortinet’s rally does not tell the whole story. Let’s break down three key strengths that reveal why the stock is a compelling investment in 2025.

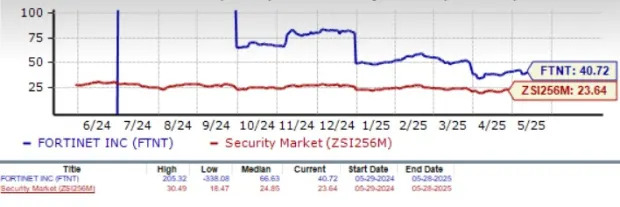

FTNT Outperforms Sector in YTD

Image Source: Zacks Investment Research

FTNT’s Q1 Shows Profitable Growth in a Tough Market

The U.S. tariff landscape continues to evolve, but based on current conditions, there’s no material impact expected on FTNT in the near term. Despite broader geopolitical uncertainties, Fortinet is still seeing strong demand for its cybersecurity offerings. The company’s pipeline remains healthy, with stable close rates and sales cycles that are well within historical norms.

Total revenues in the first quarter of 2025 rose 14% year over year to $1.54 billion. Product revenues reached $459 million, up 12% year over year, supported by double-digit growth in both hardware and software solutions. FortiGate hardware performed particularly well across low-end and high-end models, while time-based software licenses grew more than 30%.

Total billings grew 14% year over year to $1.6 billion, with unified SASE and AI-driven SecOps contributing 18% and 29% growth, respectively. Gross margin expanded 380 basis points to 81.9%, and operating margin reached a record 34.2% in the first quarter. Fortinet also added more than 6,300 new customers during the quarter, up 14% from the prior year, signaling continued momentum despite broader market headwinds.

FTNT’s Unified Approach Gives it a Competitive Edge

The cybersecurity market is extremely competitive and characterized by rapid technological change. Among others, Fortinet’s competitors include

Palo Alto Networks

PANW,

Cisco Systems

CSCO and

CrowdStrike

CRWD. Shares of Palo Alto Networks, Cisco Systems and CrowdStrike have returned 3.2%, 7% and 37%, respectively, YTD.

Palo Alto Networks has partnered with NVIDIA to build AI-driven private 5G security solutions, reflecting its commitment to next-generation technologies. Cisco Systems has also deepened its collaboration with NVIDIA, aiming to deliver AI-ready data center networking solutions, which has been a game changer for the company. Meanwhile, CrowdStrike is seeing strong momentum with its Falcon platform, promoted as an “AI-native SOC,” with growing adoption of its Charlotte AI for detection, triage, workflows, and response.

Fortinet differentiates itself from these competitors with its single, organically developed FortiOS, including its firewall, SD-WAN, secure web gateway, CASB and DLP. This unified design drove 18% growth in SASE billings and 26% in SASE ARR in the first quarter of 2025, with enterprise penetration reaching 11%, up nearly 10% sequentially. FTNT’s approach reduces complexity and cost, enabling faster adoption and stronger performance. As demand shifts toward integrated, scalable platforms, Fortinet is gaining ground across secure networking, SASE and AI-driven SecOps.