Dollar Drops on Renewed Trade Uncertainty, Soft Economic Data

(Bloomberg) -- Underwhelming US growth and labor reports weighed on the dollar Thursday, amplifying investor uncertainty over the economic outlook after a court ruled that the majority of President Donald Trump’s global trade tariffs are illegal.

Most Read from Bloomberg

A Bloomberg dollar gauge slumped alongside Treasury yields after data showed weekly jobless claims rising more than estimated and the US economy shrinking in the first quarter. The releases followed a late-Wednesday halt by the US Court of International Trade on many of the Trump administration’s sweeping levies launched last month.

“The surprise court decision reinforces the depth of uncertainty overhanging the economy in 2025,” said William Adams, chief economist for Comerica Bank. “The second estimate of GDP for the first quarter demonstrates just how uncertainty is weighing on economic activity.”

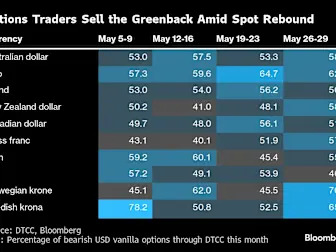

While the dollar initially rose in Asia trading on the court ruling, momentum quickly stalled during the London session. The greenback fell against all Group—of-10 peers, with losses most pronounced against more volatile currencies including the Australian dollar and Swedish krona.

Traders are now faced with another layer of complexity in the global trade dispute that has roiled markets this year. The White House has already said it will appeal the trade court’s decision, while strategists say there are plenty of alternative routes the Trump administration could pursue to ensure his flagship economic policy is not derailed.

“It’s quite likely that the administration will find a way to challenge and potentially overturn this court ruling, but even still, what this serves to do is further undermine confidence in the larger US economic picture,” said Helen Given, a foreign-exchange trader at Monex Inc. “Continued instability and uncertainty on the global trade front is only continuing to erode the dollar’s status as a global haven currency.”

The Bloomberg Dollar Spot Index fell 0.3% as of 10:00 a.m. in New York. Yields on 10-year US Treasuries fell some four basis points to 4.44%, while the policy-sensitive two-year yield slipped around four basis points to 3.95%. US stock markets advanced at the cash open.

The Court of International Trade’s decision suspends the majority of Trump’s tariffs: the global flat tariff, elevated rates on China and others, and fentanyl-related tariffs on China, Canada and Mexico are all covered by the ruling. But others imposed under different powers are unaffected, including those on steel, aluminum and automobiles.