Bond Traders See Treasuries Selloff Going Even Further

(Bloomberg) -- Traders rattled by the rout in long-dated Treasuries are turning more bearish as yields continue to oscillate around a key 5% psychological threshold.

Most Read from Bloomberg

A JPMorgan Chase & Co. survey of traders released Wednesday spotlighted that investors expect the selloff to worsen, keeping yields elevated in the $29 trillion Treasury market. The survey’s all-client category for outright short positions — which includes central banks, sovereign wealth funds, real money and speculative traders — has climbed to the most since around mid-February.

The bearish sentiment comes on the tail of a decline in global long-dated bonds as investors grow concerned about widening government fiscal deficits. The US 30-year yield is lingering around 4.97% after soaring last week to 5.15%, the highest since October 2023, amid the US losing its top credit score, a steep selloff in Japan’s super-long bonds and the passing of President Donald Trump’s tax-bill in the House.

Long-bonds got some relief Tuesday as a global debt rally sent benchmark yields tumbling. However, the 30-year yield still hovering around 5% signals investors remain fickle. That’s being expressed in the options market too, where traders are paying higher premiums to hedge an extended selloff in long-bond futures versus a rally.

“This is a global steepening of the yield curve,” said Leah Traub, a portfolio manager at Lord Abbett & Co. “There are a lot of different nuances to the same story, which is that demand for longer-term securities is diminishing at the same time as supply is growing. That’s going to put pressure on the long end of all these curves.”

Meanwhile, a five-year note auction that drew record indirect demand Wednesday and a two-year auction Tuesday that was also well-received further underscore the disparity between investor interest for shorter-dated debt compared to long-bonds. Traders will next turn their focus to a $44 billion seven-year note sale on Thursday.

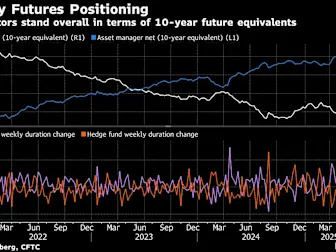

Here’s a rundown of the latest positioning indicators across the rates market:

JPMorgan Treasury Client Survey

In the week up to May 27, investor outright short positions increased by 2 percentage points to the most since Feb. 10. The net long position now sits at the least since Feb. 3.

Most Active SOFR Options

Across SOFR options out to the Dec25 tenor, the 94.875 strike has been active over the past week. That’s largely down to the flows, including a large buyer of SFRZ5 95.375/94.875 1x2 put spreads, which also accounts for the gains in open interest seen over the past week in the 95.375 strike.