Elevance Looks Cheap Now: But is it Time to Buy or Dodge?

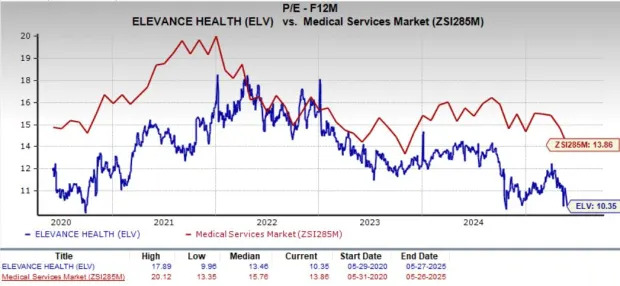

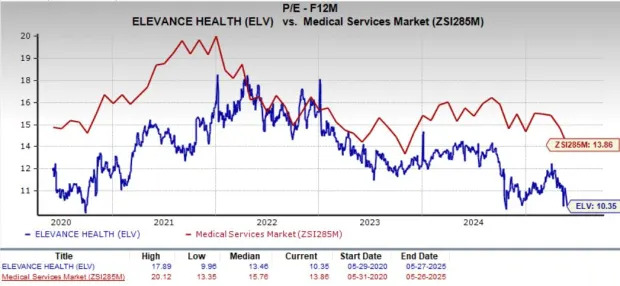

Elevance Health, Inc. ELV, a leading U.S. health benefits provider, appears to be trading at a discount. Its forward 12-month P/E ratio stands at just 10.35X, significantly below its five-year median of 13.46X and the industry average of 13.86X. Compared to peers, UnitedHealth Group Incorporated UNH and Humana Inc. HUM, which trade at 12.06X and 14.73X, respectively, ELV looks attractively valued. It currently holds a Zacks Value Score of A, highlighting strong valuation fundamentals.

But is this discount a sign of hidden opportunity, or a red flag? Let’s explore the drivers behind Elevance’s valuation and its long-term outlook.

Image Source: Zacks Investment Research

Tailwinds Fueling Elevance’s Growth

Headquartered in Indianapolis, Elevance is well-positioned for sustained growth, underpinned by strategic initiatives across its commercial and government segments. Elevance continues to see steady growth in its commercial segment. In 2024, risk-based and fee-based commercial memberships grew 4.6% and 1% year-over-year. Its Individual Commercial business is especially strong, reporting a 14.2% surge in the first quarter of 2025 alone.

By exiting underperforming markets, Elevance has streamlined its government business, improving overall efficiency. It also has room to expand its Medicare Advantage footprint in underpenetrated states, which could unlock future growth.Vision and dental memberships continue to witness growing momentum.

With a Return on Invested Capital of 9.94%, far above the industry average of 5.79%, Elevance demonstrates superior capital deployment. Its $84.1 billion market cap gives it the scale to pursue strategic acquisitions and reallocations toward higher-margin businesses.

ELV remains committed to returning capital to shareholders. In the first quarter of 2025 alone, it repurchased $880 million worth of shares and had $8.4 billion remaining under its buyback authorization. Its dividend yield of 1.82% also exceeds the industry average of 1.40%.

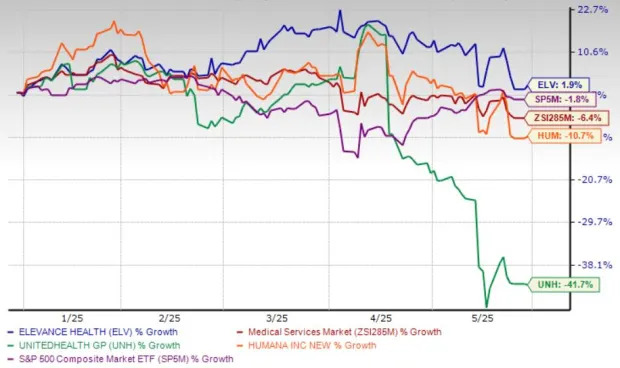

Stable Market Performance Amid Volatility

Despite headwinds in the broader market, ELV shares have gained 1.9% year to date, outperforming both the industry and the S&P 500. In contrast, UnitedHealth and Humana have posted declines, reflecting broader sectoral pressure.

Price Performance – ELV, Industry, S&P 500, UNH & HUM

Image Source: Zacks Investment Research

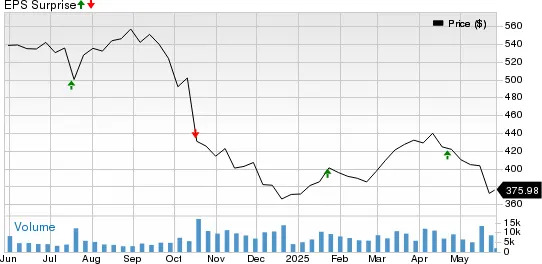

ELV’s Estimates & Surprise History

The Zacks Consensus Estimate for Elevance’s 2025 and 2026 EPS implies a 4.2% and 13.8% uptick, respectively, on a year-over-year basis. The estimates remained stable over the past week. Moreover, the consensus mark for 2025 and 2026 revenues suggests an 11.2% and 7.1% increase, respectively.