MTG Near 52-Week High: Time to Buy the Stock for Solid Returns?

Shares of

MGIC Investment Corporation

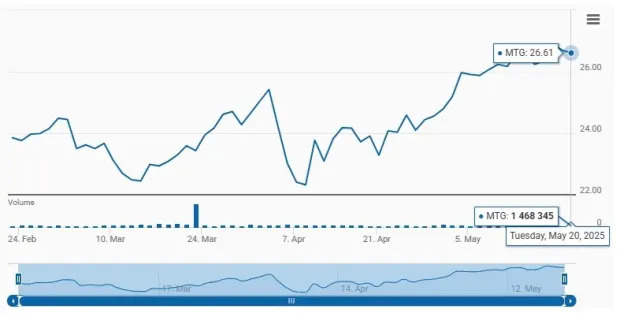

MTG closed at $26.61 on Tuesday, near its 52-week high of $26.92. This proximity underscores investor confidence. It has the ingredients for further price appreciation. The stock is trading above the 50-day and 200-day simple moving averages (SMA) of $24.57 and $24.68, respectively, indicating solid upward momentum. SMA is a widely used technical analysis tool to predict future price trends by analyzing historical price data.

With a market capitalization of $6.31 billion, the average volume of shares traded in the last three months was 2.45 million.

MTG Price Movement vs. 50-Day Moving Average

Image Source: Zacks Investment Research

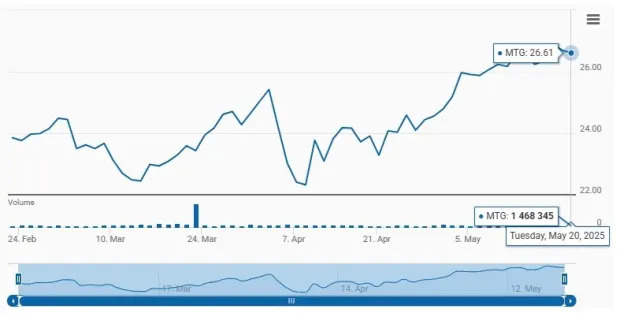

MTG is an Outperformer

Shares of MGIC Investment have gained 28% in the past year, outperforming its industry, the Finance sector and the Zacks S&P 500 composite’s growth of 6.2%, 18.6% and 12.1%, respectively.

MTG Outperforms Industry and Sector, Outperforms S&P 500 in 1 Year

Image Source: Zacks Investment Research

MTG Shares are Affordable

MGIC Investment shares are trading at a price to forward 12-months earnings of 1.23X, lower than the industry average of 2.45X. Its pricing, at a discount to the industry average, gives a better entry point to investors. Also, it has a Value Score of B. Shares of other insurers like Radian Group Inc. RDN, Assurant, Inc. AIZ and CNO Financial Group, Inc. CNO are trading at a discount to the industry average.

Image Source: Zacks Investment Research

MTG’s Favorable Return on Capital

Return on invested capital (ROIC) has been increasing over the last few quarters as the company raised its capital investment over the same time frame. This reflects MTG’s efficiency in utilizing funds to generate income. ROIC was 11.4% in the trailing 12 months, better than the industry average of 2%.

MTG’s Growth Projection Encourages

The Zacks Consensus Estimate for 2025 revenues is pegged at $1.25 billion, implying a year-over-year improvement of 2.9%. The consensus estimate for 2026 earnings per share and revenues indicates an increase of 5.9% and 2.9%, respectively, from the corresponding 2025 estimates.

Earnings have grown 12% in the past five years, better than the industry average of 10.3%.

Earnings Surprise History

MGIC Investment surpassed earnings estimates in each of the last four quarters, the average being 15.88%.

Optimistic Analyst Sentiment on MTG

One out of the three analysts covering the stock has raised estimates for 2025 and 2026 over the past 30 days. Thus, the Zacks Consensus Estimate for 2025 and 2026 moved 1.4% and 2.4% north, respectively, in the last 30 days.